When A Car Is Totalled, Is It Write Off Or Ride Off?

Is it write off or ride off? It all depends on your perspective.

From the driver’s seat, it might be more accurate to say that the car is a ride off. But from the insurance company’s perspective, it would be more accurate to say that the car is a write off.

It all comes down to semantics in the end. But what does it mean for you when your car is written off?

Is it write off or ride off? It all depends on your perspective.

From the driver’s seat, it might be more accurate to say that the car is a ride off. But from the insurance company’s perspective, it would be more accurate to say that the car is a write off.

It all comes down to semantics in the end. But what does it mean for you when your car is written off?

What makes a car a write off Australia?

There are a few different things that can make a car a write off in Australia.

Firstly, if the cost of repairs would exceed the value of the car, it is considered a write-off.

Secondly, if the car has been stolen and not recovered, it is also considered a write-off.

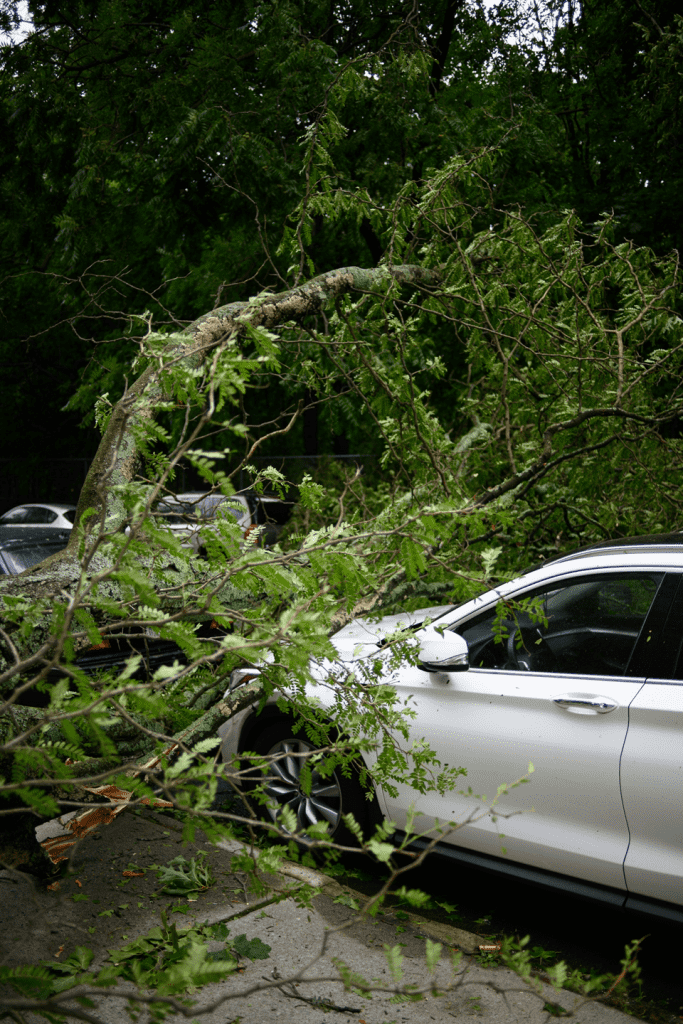

Finally, if the car has been damaged beyond repair in an accident, it is also considered a write-off.

How much damage does it take to write-off a car?

The amount of damage that it takes to write-off a car can vary depending on the make and model of the car as well as the severity of the damage.

For example, if a car has been in a major accident and the frame is bent, it is likely to be written off.

However, if the damage is more minor, such as a dent or a scratch, it is less likely to be written off.

Statutory write-off

A statutory write-off is a car that has been so badly damaged, it’s not economical or safe to repair. In Australia, each state and territory has different rules about what classifies as a write-off.

For example, in New South Wales, a car is considered a write-off if repairs would cost more than the car is worth, or if the car has been stolen and not recovered.

In Victoria, a car is considered a write-off if it would cost more to repair than the value of the car, or if it’s been damaged beyond repair in an accident.

In Queensland, a car is considered a write-off if repairs would cost more than the value of the car, or if it has been stolen and not recovered.

In South Australia, a car is only considered a write-off if it has been stolen and not recovered.

In Western Australia, a car is only considered a write-off if it has been stolen and not recovered, or if it has been damaged beyond repair in an accident.

In Tasmania, a car is only considered a write-off if it has been stolen and not recovered.

In the Northern Territory, a car is considered a write-off if repairs would cost more than the value of the car, or if it has been stolen and not recovered.

In the Australian Capital Territory, a car is considered a write-off if repairs would cost more than the value of the car, or if it has been stolen and not recovered.

As you can see, there are some differences between the states and territories when it comes to what classifies as a write-off. But in general, a car is only considered a write-off if it would be too expensive to repair, or if it’s been stolen and not recovered.

Repairable write off

There is another type of write off which is called repairable write-off. A repairable write-off is a car that has been damaged, but can be repaired.

However, in order to be classified as a repairable write-off, the repairs must not exceed the cost of the vehicle.

If the repairs would cost more than the value of the car, it would be classified as a statutory write-off.

In some states and territories, repairable write-offs must be inspected by an authorised officer before they can be repaired and registered.

For example, in Queensland, a repairable write-off must be inspected by a licensed vehicle examiner and issued with a ‘certificate of identity’ before it can be repaired and registered.

In New South Wales, a repairable write-off must be inspected by an authorised officer and issued with a ‘ certificate of roadworthiness’ before it can be repaired and registered.

As you can see, there are some strict rules surrounding repairable write-offs. So if you’re thinking of buying a repairable write-off, make sure you do your research first and understand the rules in your state or territory.

There are some exceptions to the rule that a car must be repaired before it can be registered.

What are my rights when my car is written off?

If your car is written off, you have the right to:

- a refund of any money you have paid for the car; or

- a replacement car of the same make and model; or

- a repair of the car to an ‘as new’ standard.

However, if you have already accepted a payment for the car, you may not be entitled to a refund.

It’s important to remember that if your car is written off, the insurance company owns the car. This means that you don’t have the right to sell the car or use it for parts.

If you try to sell a written-off car, you could be charged with fraud.

If you’re thinking of buying a written-off car, there are a few things you should keep in mind.

Make sure you get a written-off vehicle report from the insurer or repairer. This report will tell you whether the car has been repaired to an ‘as new’ standard.

If the car hasn’t been repaired to an ‘as new’ standard, it may not be safe to drive and could cause you problems when you try to register it.

You should also get a mechanical inspection report from a qualified mechanic. This report will tell you whether the car is in good working condition.

Can you dispute a write-off?

If you disagree with the decision to write off your car, you can dispute it.

You will need to provide evidence to support your case, such as quotes from repairers.

If you’re still not happy with the decision, you can make a complaint to the insurer or take your case to court.

As you can see, there are some strict rules surrounding write-offs. So if your car has been written off, make sure you understand your rights and the process for disputing the decision.

This content is for informational purposes only and does not constitute legal advice. For more information, please contact a lawyer.

What is a write-off tax?

A write-off tax is a tax deduction that can be claimed for the cost of repairs or improvements made to a property.

The write-off tax can be claimed for repairs or improvements made to both residential and commercial properties.

To claim the write-off tax, you will need to provide receipts for the repairs or improvements made.

The write-off tax can be claimed for a wide range of repairs or improvements, such as:

- painting;

- repairs to plasterwork;

- repairs to plumbing or electrical systems;

- installation of new windows or doors;

- installation of insulation;

- repairs to roofs;

- construction of new walls or partitions.

The write-off tax can also be claimed for the cost of landscaping, such as:

- planting trees or shrubs;

- installing a lawn;

- constructing a fence.

If you’re thinking of making repairs or improvements to your property, make sure you check whether you can claim the write-off tax.

This content is for informational purposes only and does not constitute legal advice. For more information, please contact a lawyer.

If you’re looking to sell your written-off car, Blue Sky Auto Scrap Brisbane is the perfect place for you. We offer top prices for scrap cars and we’ll take care of all the paperwork so you can relax and enjoy your new-found cash. Contact us today to get started!